Great Recession

![]()

This article or section needs a revision: the article is outdated and completely unstructured. It would almost need to be rewritten from today's perspective.

Please help to improve it, and then remove this marker.

The Great Recession refers to a near-global recession that began around 2007 and peaked in 2009. The recession was triggered by various factors, in particular by the bursting of a real estate price bubble (especially in the USA) and the accompanying global financial crisis and banking crisis, which were later followed by sovereign debt crises such as the Greek sovereign debt crisis. In addition, there were hunger crises in poor countries. The extent to which these sub-crises are interrelated is the subject of debate; a direct connection with the global economic crisis cannot be established beyond doubt. The end of the economic crisis can be estimated at around mid-2009 for Germany and at the end of 2013 for the eurozone as a whole.

In March 2012, at the Board of Governors of the Federal Reserve System 2012 conference, the Bank for International Settlements stated in its conclusion that debt cannot be solved with debt. Although this sounds plausible, it is not correct in terms of balance mechanics - since credit-financed expenditures enable other debtors to service their credit liabilities (balance sheet contraction) - i.e. one debtor pays off another - the BIS statement must in any case be qualified (also from the perspective of credit mechanics and macroeconomic financial accounting).

For example, Robert Shiller warned Europe and the US against excessive saving. Similarly, the report by Olivier Blanchard (Chief Economist of the IMF), published on 1 January 2013 on the IMF website (WP 13/1), points to a possible austerity paradox by also admitting to having assumed the level of the fiscal multiplier to be too low and to have massively underestimated the influence of national austerity policies on economic growth. Olli Rehn (EU Commissioner for Monetary Affairs) doubts the correction of the level of the fiscal multiplier, or its general ability to be determined, and continues to adhere to European austerity programmes.

Alfred Nobel Memorial Prize in Economics-winning economist Joseph Stiglitz explains that no major economy ever overcame a crisis through austerity, and literally, "Austerity only makes things worse - it weakens demand, increases unemployment and social costs - and leads to recession."

The disinflationary trend that has been noticeable since the beginning of 2013 in view of the continuing negative level of import prices for Germany is intended by EU economic policy (vis-à-vis the crisis states) in the context of internal devaluation (structural reforms/competitiveness). There is still a risk of declining net borrowing (across sectors). European companies have been extremely reluctant to invest since 2012. Despite all forecasts of an upswing, economic momentum weakened from mid-2014 onwards, even in export-oriented Germany, and deflation (-0.2%) occurred for the first time in the history of the eurozone in December 2014.

The robust growth in many countries around the world in 2017/2018, including in all G-20 countries for the first time since the beginning of the financial crisis, led some analysts to believe that a phase of synchronized global growth had occurred.

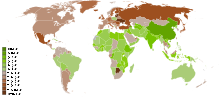

Economic growth 2009, in brown Countries with recession

Overview

- World financial crisis

- World financial crisis/regional development

- Food price crisis 2007-2008

- Iceland's financial crisis 2008-2011

- Euro crisis

- Greek sovereign debt crisis

- Protests in Greece 2010-2012

- Protests in Spain 2011/2012

- Plataforma de Afectados por la Hipoteca

- Budget crisis in the United States 2011

- State bankruptcy in Belize 2012

Search within the encyclopedia