Blockchain

A blockchain is a continuously expandable list of data records, called "blocks", which are linked together using cryptographic methods. Each block typically contains a cryptographically secure hash (scatter value) of the previous block, a timestamp and transaction data.

The term blockchain is also used when an accounting system is managed in a decentralized manner and the correct state in each case must be documented because many participants are involved in the accounting. This concept is called distributed ledger technology or DLT. What is to be documented is irrelevant to the concept of blockchain. What matters is that later transactions build on earlier transactions and validate them as correct by proving knowledge of the earlier transactions. This makes it impossible to tamper with or erase the existence or content of the earlier transactions without simultaneously destroying all later transactions as well. Other participants in the decentralized ledger who still have knowledge of the later transactions would recognize a tampered copy of the blockchain by the fact that it shows inconsistencies in the calculations.

The procedure of cryptographic chaining in a decentrally managed accounting system is the technical basis for cryptocurrencies, but can furthermore contribute to the improvement or simplification of transaction security in distributed systems compared to centralized systems. One of the first applications of blockchain is the cryptocurrency Bitcoin.

The way it works is similar to the journal of accounting. It is therefore also referred to as the "Internet of value". A blockchain allows unity to be achieved between nodes in a decentralized network. (See also: Byzantine error).

"The basic idea of the notched stick is extremely simple: in this technique, which is as primitive as it is sophisticated, two sticks are placed side by side and carved across, each notch corresponding to a debt. The creditor takes one stick, the debtor the other. The creditor will not be able to add a notch and the debtor will not be able to eliminate one, since comparing the two sticks would immediately reveal the forgery.

Pretty simple, isn't it? An ancient, but also highly modern technique. For the blockchain - this invention that seems to us to be the greatest novelty of our time - is nothing more than a global notch extended to countless computers. Instead of a counting stick shared by two people, we're dealing with a track stored on as many hard drives as possible to prevent tracks (blocks) from being added or deleted."

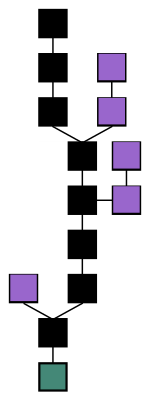

The determining blockchain (black) consists of the longest sequence of blocks starting from the origin to the current block. Alternative chains are orphaned (purple) as soon as they are shorter than another chain.

History

The first principles for cryptographically secured chaining of individual blocks were described by Stuart Haber and W. Scott Stornetta in 1991, by Ross J. Anderson in 1996, and by Bruce Schneier and John Kelsey in 1998. In 1998, Nick Szabo also worked on a mechanism for a decentralized digital currency, which he called "Bit Gold". In 2000, Stefan Konst developed a general theory on cryptographically secured chaining and derived various solutions for its implementation.

The concept of the blockchain as a distributed database management system was first described by Satoshi Nakamoto in the Bitcoin white paper in 2008. The following year, he published the first implementation of the Bitcoin software, thereby launching the first publicly distributed blockchain.

Properties

New blocks are created via a consensus process and then attached to the blockchain. The most popular consensus method is the proof-of-work method; however, there are numerous other forms of establishing consensus (proof of stake, proof of capacity, proof of burn, proof of activity). The sequential storage of data in a blockchain means that it cannot be subsequently changed without damaging the integrity of the entire system. This makes the manipulation of data much more difficult. The decentralized consensus mechanism replaces the need for a trusted third party to confirm the integrity of transactions.

Linking principle

A blockchain is a chained sequence of data blocks that continues to be updated over time.

Decentralized storage

A blockchain is not stored centrally, but is maintained as a distributed register. All participants store their own copy and update it.

Consensus mechanism

It must be ensured that an identical chain is created for all participants. To do this, proposals for new blocks must first be developed. This is done by validators (called "miners" in Bitcoin). Then the participants must agree on which proposed block will actually be inserted into the chain. This is done through a so-called consensus protocol, an algorithmic procedure for voting.

Manipulation security

Cryptographic procedures ensure that the blockchain cannot be subsequently changed. The chain of blocks is therefore unchangeable, forgery-proof and tamper-proof.

Transparency/confidentiality

The data stored on the blockchain can be viewed by all participants. However, this does not necessarily mean that it can be meaningfully read by all, as content can be stored in encrypted form. Blockchains thus allow a flexible design of the degree of confidentiality.

Non-repudiation

By using digital signatures, information can be stored in the blockchain that proves in a forgery-proof manner that participants have indisputably deposited certain data, e.g. have initiated transactions.

Application example Bitcoin

See also: "Blockchain" in the article Bitcoin

In Bitcoin, a blockchain consists of a series of data blocks, each of which combines one or more transactions and provides them with a checksum, i.e. they are combined in pairs to form a hash tree. The root of the tree (also called Merkle root, or top hash) is then stored in the associated header. The entire header is then hashed as well; this value is stored in the subsequent header. This ensures that no transaction can be changed without also changing the associated header and all subsequent blocks.

Bitcoin's blockchain is the oldest blockchain. It started in January 2009, had a size of approximately 221.846 GB as of early June 2019, and was redundant and publicly accessible on approximately 9,516 nodes as of June 5, 2019.

Application example Auditing

Auditing in information technology is about recording security-critical operations of software processes. This applies in particular to the access to and modification of confidential or critical information. Auditing is suitable for a blockchain because it produces relatively small amounts of data and at the same time has high security requirements.

A blockchain can protect the audit log (also known as the audit trail) from change. In addition, the individual entries should be provided with a digital signature to ensure authenticity. A decentralized consensus mechanism, as with Bitcoin, is not absolutely necessary.

Since, on the one hand, confidential information is stored and, on the other hand, no element of the blockchain can be deleted without making it invalid, the individual entries can also be encrypted. Since the implementation of blockchains is currently (as of May 2017) very complex due to the lack of easy-to-use implementations, their use is only recommended for information that requires special protection.

Examples of use include auditing medical information systems (e.g., electronic health records), contracts and monetary transactions with high financial value, military secrets, legislation and electronic voting, security management of critical facilities, or data from large corporations covered by the Sarbanes-Oxley Act or similar directives.

As announced in July 2018, the four accounting firms Deloitte, KPMG, PricewaterhouseCoopers International and Ernst & Young are testing a blockchain service for auditing the interim reports of public companies. The aim is to enable auditing firms to track business transactions through a traceable and tamper-proof data chain in a decentralized manner, streamlining and automating the confirmation process.

Application example capital markets

Blockchain is also being considered as an application in capital markets. The R3 consortium, with several financial institutions, has released the Corda platform, which is intended to provide a substructure for blockchain applications for capital markets. The platform is expected to be in use until 2021 as a pilot for the Swedish Riksbank's e-krona, in collaboration with Accenture.

The largest areas of application for capital markets are in the settlement of shares and other financial instruments, the issuance of syndicated loans and the financing of companies with equity.

Application example supply chains for food

The use of a blockchain, in which the participants jointly document the supply chain transactions, can enable significant cost and time savings here. A blockchain could eliminate the distrust of a central register-keeping actor, since a blockchain register is accessible to all participants. In this context, the accounting and reading rights can be distributed in a tiered manner, adapted to the different user groups and their needs, such as manufacturers, freight forwarders, customs and various consumers. Thus, there is no complete transparency that competitors could exploit. For end consumers, for example, only read rights can be granted, on the basis of which the origin and the entire supply chain can be transparently and verifiably traced from the harvest to processing, logistics, customs clearance, certification, food monitoring, the wholesaler to the retailer.

There is also automation potential for the documentation requirements that must be met: For example, a sensor installed in the container could measure the temperature of food, write the measurement data to the blockchain and thus document complete compliance with the cold chain. If it were not adhered to, an appropriately set up smart contract could automatically sound the alarm.

Simplified Bitcoin Blockchain

Questions and Answers

Q: What is a blockchain?

A: A blockchain is a method of storing a list of entries that cannot be changed easily after they are created. It uses concepts from cryptography, such as digital signatures and hash functions, to ensure the integrity of the data.

Q: How does a blockchain work?

A: A blockchain combines two ideas - given some data it is easy to calculate a checksum over the data using special hash functions which return a value that always has the same length; and given the same input these functions must return the same output (hash value/message digest). In addition to this, each block typically also contains a timestamp and some payload. Each block uses a digital signature which allows detecting any change in the data since it was made. When new blocks are created, they contain the hash value of the previous block. Blockchains are managed by peer-to-peer networks which use protocols to communicate with each other, create and validate new blocks. Once recorded, data in any given block cannot be changed easily anymore as all subsequent blocks need to be changed too.

Q: What is double spending?

A: Double spending refers to when someone spends money more than once or attempts to spend money twice without having enough funds for both transactions.

Q: Who invented Blockchain?

A: Blockchain was invented by Stuart Haber and Scott Stornetta in 1991 as a means to assure the integrity of digital records.

Q: What did Satoshi Nakamoto reference in 2008?

A: In 2008, Satoshi Nakamoto referenced two papers by Haber and Stornetta (references 3 & 4) in his paper "Bitcoin : A Peer To Peer Electronic Cash System" which served as public transaction ledger for cryptocurrency bitcoin.

Q: What problem did Bitcoin solve with its blockchain technology?

A: With its blockchain technology Bitcoin solved double-spending problem without needing trusted authority or central server.

Q: What are some common use cases for Blockchain technology?

A: Common use cases for Blockchain technology include medical records management, identity management, food traceability, gaming and voting systems

Search within the encyclopedia